Rural Funds Group shares (ASX RFF) is the only diversified agricultural Real Estate Investment Trust (REIT) in Australia which controls more than 40 properties across sectors including almond, cattle, poultry, and vineyard. It is one of the very few commercial entities who actively seeks to provide property leasing solutions to the Australian agricultural sector.

Its assets in the portfolio are leased to high-quality tenants including Treasury Wine Estates (TWE), Olam Orchards Australia (Olam), Select Harvest, RFM Almond Fund and RFM Poultry, with a Pro Forma weighted average lease expiry (WALE) at 12.3 years.

Sitting at a market capitalization of more than A$700M, Rural Funds Group generates lease revenue and potential capital growth through owning agricultural assets.

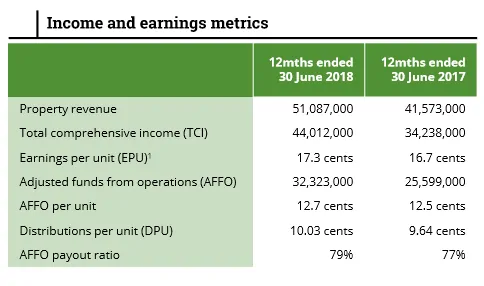

In FY18, its total comprehensive income (TCI) increased 29.4% to A$44M, earnings per unit (EPU) rose 3.6% to 17.3 cents and distribution per unit (DPU) increased 4% to 10.03 cents. Its adjusted NAV per unit sits at A$1.82 in September 2018, and it currently trades at A$2.25, at a premium of 24%.

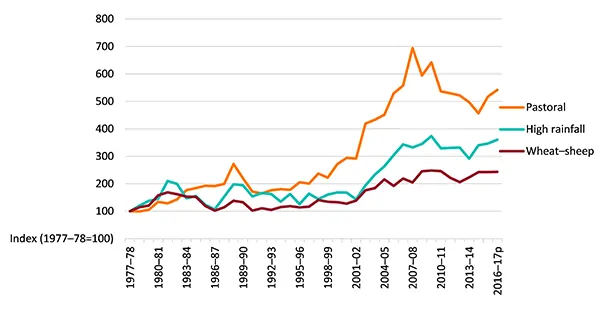

Figure: RFF – Total Unitholder Return

Assumes $10,000 invested Feb 2014 and all distributions are reinvested at the DRP price. The total return of indices as provided by S&P. Source: FY18 RFF Investor Presentation.

Source: RFF & Wilsons. NAV includes water assets at market value. Adjusted gearing includes J&F guarantee.

Table of Contents

Strategic Position

Strategy Overview

Rural Funds Group shares stable income and capital growth come from owning, and where appropriate, improving the productivity of farms. Rural Funds Group’s strategy is prominent in:

Diversification. Rural Funds Group seeks to diversify its assets in geography and sectors to smooth its earning, reduce non-climatic risks and enhance water security.

Investment thesis: Balanced Natural vs Industrial Investment. Rural Funds Group’s investment strategy is to invest in a ‘full range of asset continuum’. A natural resource predominant assets investment that offers capital growth will be balanced by infrastructure predominant assets that generate higher initial yields. A mixture of investment has also allowed lease indexation mechanism.

Diversification

As illustrated, Rural Funds Group has pursued a ‘’well-enunciated” diversification strategy in geography and sector to mitigate the impact of rainfall variability, commodity risk, and water insecurity.

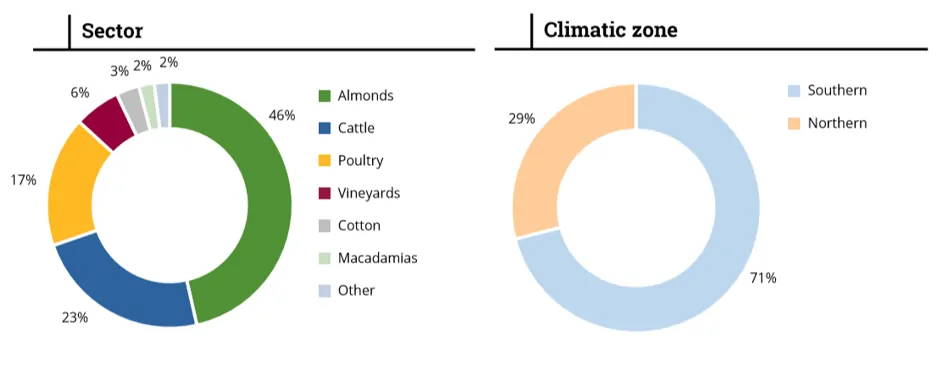

Figure: RFF – FY18 Portfolio Diversification in Geography and Sector

Source: RFF FY18 Investor Presentation

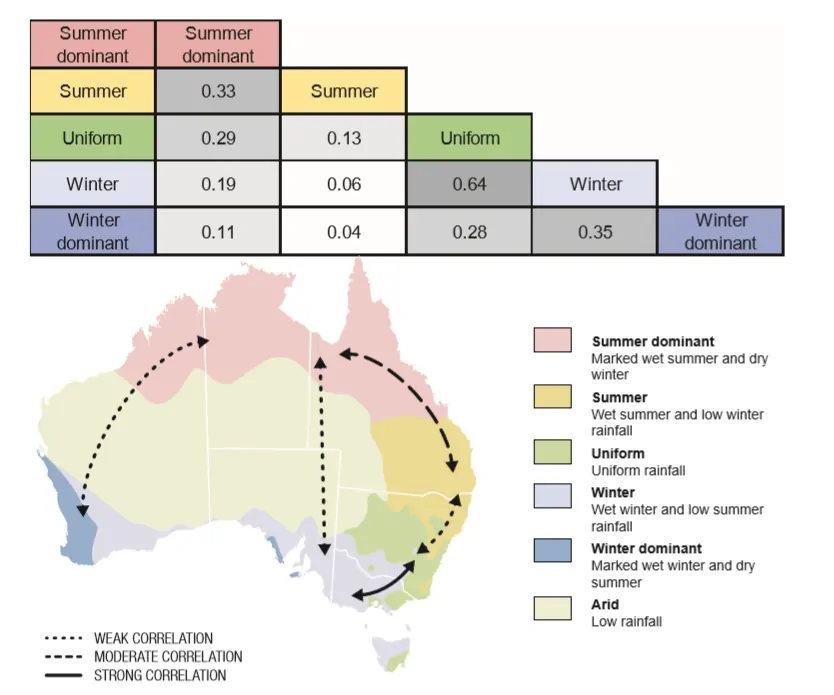

Rainfall diversification. Owning assets located in areas with low to negative rainfall correlation to each other helps hedge against rainfall volatility. As illustrated below, Rural Funds Group has investigated the correlation between annual rainfall in different weather zones and allocated its assets accordingly to minimize the impact of rainfall variability.

Figure: Correlation between annual rainfall in each of the main weather zones

Note: The table and map above present results from RFM’s correlation analysis. The table presents correlation coefficients, where ‘1’ indicates a perfect correlation, and lower values approaching zero indicate close to uncorrelated rainfall patterns. The map simplifies this analysis by presenting these relationships between rainfall zones.

Commodity diversification. As illustrated below, Rural Funds Group’s portfolio of assets spans through almond (46%), cattle (23%), poultry (17%) and vineyards (6%). Commodity diversification would reduce Rural Funds Group’s income fluctuation as new lessees are producing commodities with different seasonal and commodity price cycles.

Moreover, commodities are subject to a varying degree of exposure to non-climatic factors, such as the exchange rate, trade tariffs, and overseas demand. Expanding Rural Funds Group’s asset portfolio into more commodities will help offset the adverse impact should a particular commodity face headwind.

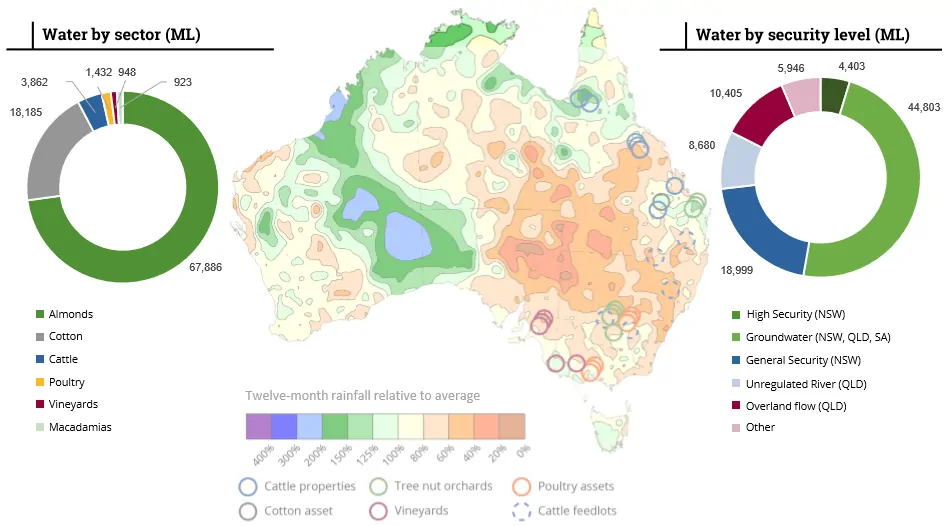

Water Security. Additionally, water security is enhanced through diversification. Rural Funds Group owns more than A$50M worth of water entitlement, more than enough to provide irrigation to its farmers and even to sell unused water rights for a higher price. As illustrated, most of Rural Funds Group’s water is classified as ‘High Security’, ‘Groundwater’ and ‘General Security’.

Figure: RFF – FY19E Portfolio Revenue Diversification

Source: RFF FY18 Investor Presentation

Figure: RFF – Climatic diversification and water security

Source: RFF FY18 Investor Presentation & Bureau of Meteorology, twelve-monthly rainfall percentages (1 August 2017 to 31 July 2018) to mean.

Investment thesis

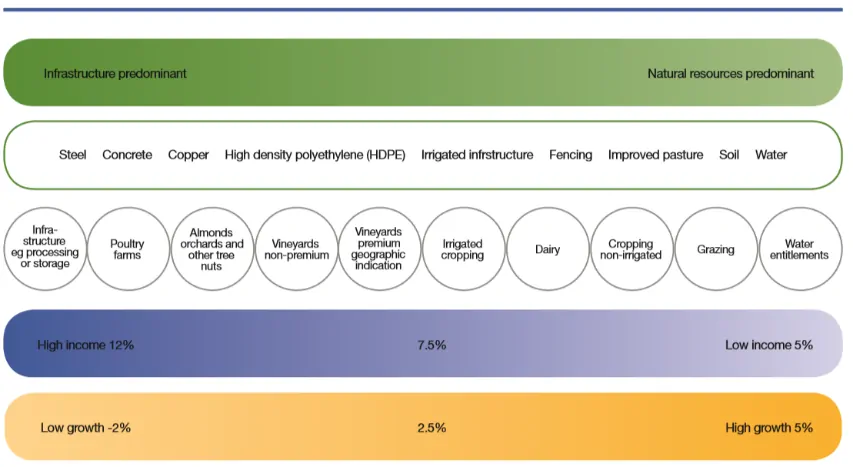

Natural vs Infrastructure. As illustrated below, Rural Funds Group’s management team categorizes the agricultural assets into ‘Infrastructure predominant’ and ‘Natural resources predominant’. The assets are evaluated based on the relative level that natural resources or infrastructure resources are embedded in their operations. ‘At the left end of this asset continuum are infrastructure assets where natural resources have little presence, and therefore relevance to capital value. The assets at the right end of the continuum are where natural resources predominate and where values are highly influenced by the reliability and quantity of rainfall, and the water holding capacity of soils.’

Infrastructure Yield and Natural Growth. As illustrated below, Rural Funds Group management believes that infrastructure assets have more capital characteristics than natural assets: it produces higher initial yield, but asset value would depreciate over time. Assets with natural resource characteristics produce lower initial income yields but experience rental growth as productivity gains over time.

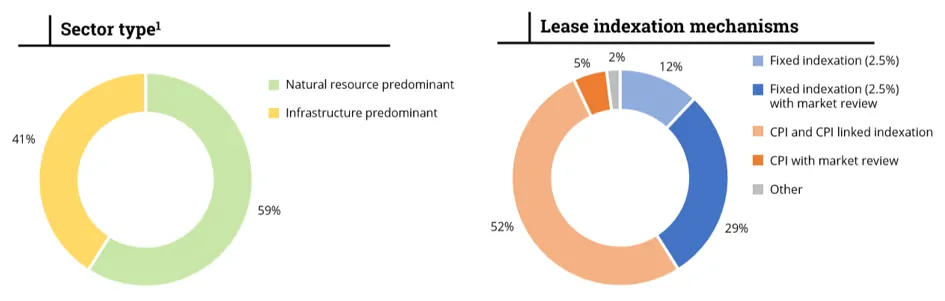

Balanced Investment Mix and Lease Indexation. Rural Funds Group’s investment strategy is to invest across the full range of the asset continuum while ensuring the asset mix continues to fund distributions consistent with current levels. As illustrated below, the current portfolio consists of 59% natural predominant assets and 41% infrastructure predominant assets, a proportion that enables Rural Funds Group to generate relatively high rental yields and hence distributions to Unitholders. Furthermore, the lower growth infrastructure asset is typically linked to CPI-linked indexation (57%), while high growth natural resource asset is linked to fixed indexation (43%). Lease indexation mechanism would help Rural Funds Group to reach its target distribution yield of 4% and retain enough capital to invest in higher yield assets.

Figure: Australian Agricultural Industry Asset

Source: RFF supplementary disclosure. The income and growth figures presented have been provided to differentiate the profile of income and growth that can be derived from different assets. They are based on RFM’s experience and observations of agricultural lease transactions and historical rates of growth.

Figure: RFF – FY19E Portfolio revenue source

Source: RFF FY18 Investor Presentation Note: Assumes poultry is infrastructure predominant, vineyards, and cattle natural resource predominant, and almond/macadamia orchards split equally.

Prospect

Industry Trend

Leasing of farmland in Australia is an under-utilised form of land tenure when compared to US or UK, and Rural Funds Group can see exceptional opportunities from the development of agricultural leasing market, mainly due to a few factors:

- Rising agricultural land price

- Positive correlation between return and farm size

- Consolidation due to highly fluctuating farm income and low income from small farms

Rising Land Price. The appreciating agricultural land price has been the main reason why the Rural Funds Group shares asset portfolio produced high performance, and the price rise is expected to continue. As illustrated below, the average annual median price growth of farmland in Australia is 6.6% over the last 20 years. And the recent land price growth reached a historic high of 5.3%, 9.3% and 7.1% in FY15, FY16 and FY17.

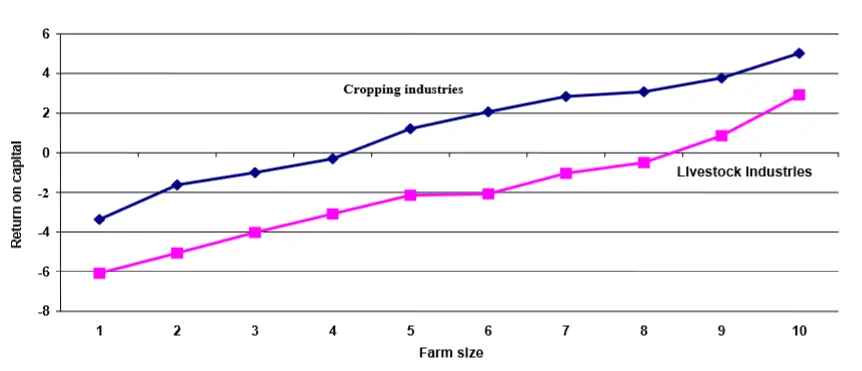

Source: Rural Bank Report 2017

Positive correlation between return and farm size. Rural Funds Group leases large farms, and these farms are expected to outperform smaller farms and generate stable rental income. As illustrated, there is a positive correlation between return and the farm size. The positive correlation is due to the economics of scales, access to modern technology, better management skills and thus enhanced productivity in bigger farms. High and stable rent is expected from such farms due to its higher return on capital and benefits Rural Funds Group’s profitability.

Figure: Land Price for broadacre farms, by zone, 1977-78 to 2016-17 average per farm

Figure: Farm Return VS Farm Size

Source: Successful Land Leasing in Australia – a guide for farmers and their advisors

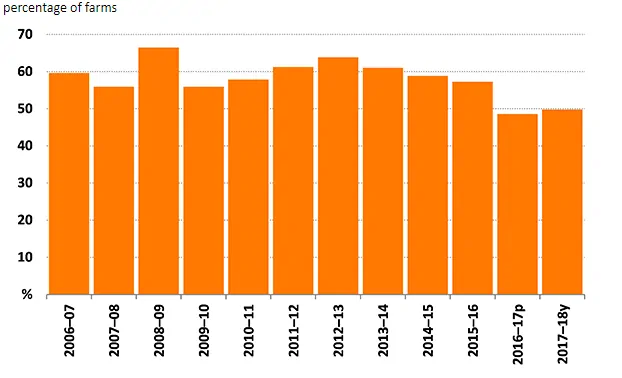

Consolidation due to low income from small farms. Smaller farms suffer from rising land prices and widely fluctuating farm income. As illustrated below, on average, 59% of vegetable-growing farms in Australia are operating in loss from 2006-2017. Moreover, as shown on the right, more than 75% of farms make less than A$50k per annum, and most of them are small farms.

Such low income has resulted in high consolidation of farms. Over the last 40 years, the number of commercial farms in Australia has nearly halved from approximately 200,000 in the 1950’s; while the average area of these farms has increased by almost 50% from 2,800 hectares to 4,100 hectares.

The consolidation trend agricultural land market gives Rural Funds Group ample opportunities to acquire underdeveloped farms. High return could be realized by Rural Funds Group through utilising its comparative advantage of scale against smaller farms.

Proportion of vegetable-growing farms with negative farm business profit, Australia, 2006–07 to 2017–18

Source: ABARES Australian vegetable-growing farms survey

Business Risk

Asset valuations and market rent review. The positive distribution growth of Rural Funds Group was mostly due to the appreciation in the value of leased properties and the increasing rental income. Rural Funds Group would conduct asset review every two years and market rent review about every five years, which would most likely increase Rural Funds Group’s income.

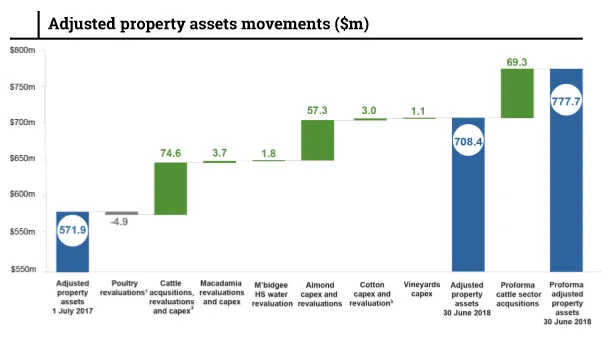

However, numerous factors could negatively impact the asset price and lease rent, including inflation, rising bond yield, negative economic outlook, worsened credit market condition and lower demand for commodities related to its assets (almond, cattle and poultry). As illustrated, retained AFFO increased drastically after the market rent review in FY17, and asset revaluation takes up 96.7% (cattle and almond) of increase in adjusted property market asset in Jun 2018, showing Rural Funds Group’s dependence on asset price appreciation.

Source: RFF FY18 Investor Presentation. Note: FY17 AFFO increased, in part, due to a Select Harvests rent review in respect to almond orchards.

Source: RFF FY18 Investor Presentation

- Directors’ valuation applied to certain poultry assets, consistent with management’s approach to reflect increasing average age of the infrastructure.

- Natal acquisition includes $53.1m cattle property aggregation acquisition, $10m loan to secure first-mortgage security over two additional properties and capitalisation of $1.9m lease incentive.

- Cotton capex of $2.4m and revaluation of $0.5m.

Interest rate risk and debt facility. Rural Funds Group has well-established hedging position against future interest rate movement and high debt facility for funding needs. As illustrated, Rural Funds Group has hedged 55.4% of debt with a weighted average duration of 7.3 years and five-year hedged rate of around 3%, enough to defend it against more US’s rapid interest increase, which is becoming more likely given the strong US economy and inflation expectation. Moreover, Rural Funds Group has sufficient funding capacity for investment opportunities, with a Pro forma headroom of A$80.2M in FY18.

Source: RFF FY18 Investor Presentation

Source: RFF FY18 Investor Presentation

- Key financial covenants for FY18: LVR <50%, ICR >2.95x, with distribution permitted at >3.15x, NTA including water entitlements >$200m, 50% hedging requirement.

- Security: Real property mortgages, general security agreement, cross guarantees between RFF and subsidiaries.

- LVR calculated as term debt drawn/directly secured assets based on independent valuations. Pro forma LVR calculated as term debt drawn plus contingent liabilities relating to the limited guarantee of $75m divided by directly secured assets based on independent valuations plus the Feedlots and Comanche acquisition values.

- Current hedges only.

- Proportion hedged calculated as current hedges/term debt drawn and may vary from covenant with bank consent.

- Duration remaining as at 30 June 2018 and includes forward start hedges.

Business strategy and Acquisition risk. Although Rural Funds Group shares is a defensive REIT that relies on rising asset values and rental payment under the lease contract, a significant portion of the growth in Rural Funds Group is driven by the experienced management team and execution of its acquisition strategy.

Rural Funds Group shares saw high growth in recent years because it builds the asset portfolio and cash yield through acquisition and productivity improvement and any change or impediment to implementing this strategy, such as the leave of an experienced senior member, may adversely impact Rural Funds Group’s operations and future financial performance.

Financial Performance and Peer Comparison

Financial Performance

Rural Funds Group shares had good financial performance in FY18. As illustrated below, in FY18 Rural Funds Group’s total comprehensive income (TCI) increased 29.4% to A$44M, earnings per unit (EPU) increased 3.6% to 17.3 cents and distribution per unit (DPU) increased 4% to 10.03 cents. Moreover, the number of properties increased 25% to 44, showing the outstanding progress in business acquisition, while WALE stays at more than 12 years and gearing remains under 30%.

Source: RFF FY18 Investor Presentation

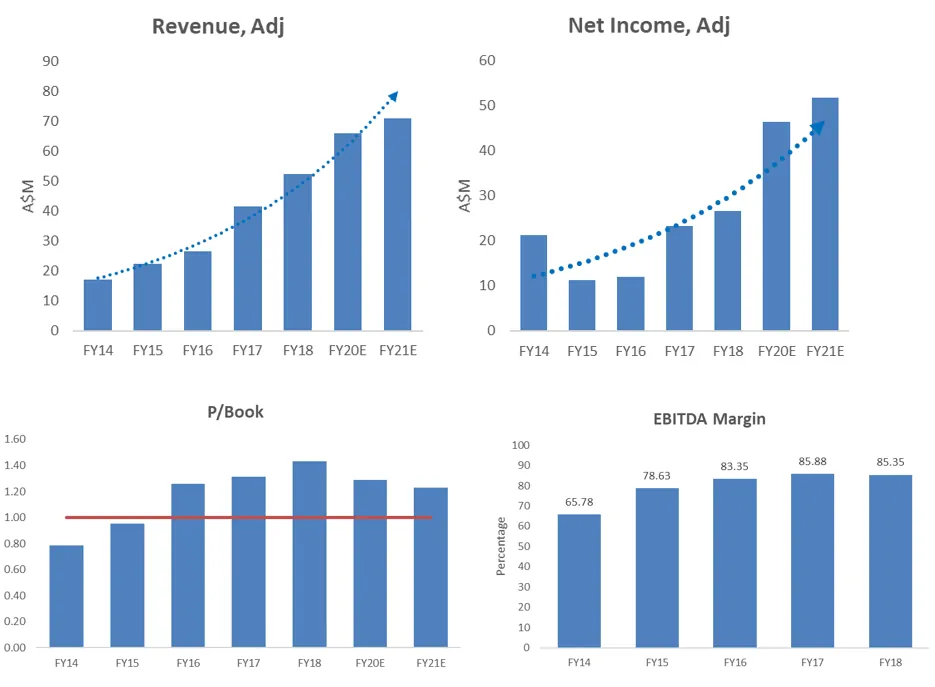

Source: Bloomberg and MF & Co Asset Management

As illustrated above, Rural Funds Group’s adjusted revenue is expected to grow 410%, or YoY 26.5%, from A$17M to A$71M FY14-20. Net income is expected to grow 240%, or YoY 16%, from A$21M to A$52M. P/Book ratio is consistently over 1.20, while its EBITDA margin was improved consistently, from 65% to 85% FY14-18.

Peer Comparison

Three characteristics were selected to screen the competitors of Rural Funds Group, including market capitalization (100M to 1000M), exposure to the agriculture sector and geographic location (Australia). Rural Funds Group is such a unique REIT that focuses on investment in agricultural land that should more criteria is added, such as limiting search to REITs or companies that specialise in agricultural leasing solution, there would not be any appropriate peer. The result of screening is shown below:

RFF tops EBITDA Margin and Net Income Margin. As illustrated, Rural Funds Group tops LTM EBITDA margin among its peers at 79.8%, while the mean and median EBITDA margin sits at 9.4% and 13.2%. Moreover, RFF ranks first in net income margin at 68.93%, with mean and median net income margin are 17.47% and 18.65% respectively.

RFF is fairly priced, paying good dividends. As shown, Rural Funds Group’s P/Diluted EPS before extra LTM sits at 15.9x, low than peers’ mean (18.2x) and median (17.2x). Furthermore, its P/BV LTM (1.5x) falls between the peers’ median (0.9x) and mean (1.6x). And Rural Funds Group declared 10 cents of dividend in FY18 with its dividend yield reaching 4.6%, higher than peers’ mean (3.1%) and median (3.4%).

Rural Funds Group is a specialised REIT that invests in agricultural assets and provides agricultural leasing solution in Australia. With a diversified portfolio of assets and a balanced investment thesis, Rural Funds Group generates most of its income from rental payments and land appreciation, both of which are well protected from market volatility. As the agricultural land price is trending higher and the big farm model is highly profitable, Rural Funds Group is expected to offer defensive income as well as a good taste of growth in the long run.