PWR Holdings Limited (ASX PWH) is an Australia-based company which produces world-class cooling solutions for motorsports and automotive industry.

Apart from providing high-performance radiators, intercoolers and oil coolers for its elite customers such as Formula One, V8 Supercars, NASCAR and DTM, PWH also support customers by customising products to suit their specific cooling requirements. PWR holdings shares have seen stable growth in its sales revenue and accumulated the market capitalization of AU$314 million. Apart from its main business, PWH also generates revenue from automotive aftermarket, emerging technologies and OEM – original equipment manufacturers.

PWR Holdings is a top high growth stock to buy for 2019.

Table of Contents

- 1 Highly Experienced Team

- 2 Niche Market With Few Competitors

- 3 Strong Financial Performance

- 4 Strong Growth of the Motorsport Industry

- 5 PWH Continues To Research New Technologies

- 6 Capital Investment In Future Capacity

- 7 PWH Faces Key Skills and IP Risk

- 8 Currency Risk

- 9 Generous Dividend

- 10 PWR Holdings Shares Have Strong Upside

Highly Experienced Team

PWR Holdings is recognized globally as the pre-eminent cooling technology solutions provider to top-tier racing teams. PWH’s senior teams have over 100+ years of combined experience in the automotive and cooling technology industries. The expert supervisors and world-class engineers also allow PWH to operate across all high-end automotive cooling technology markets around the world. PWH has a strong reputation among its global customers and has a number of strong relationships with top tier teams.

Niche Market With Few Competitors

PWH targets niche markets including global leading teams across the major racing competitions, high-end aftermarket customers and premium performance vehicle manufacturers with a high technical requirement. PWH has relatively few competitors in this market with a low volume of production.

Strong Financial Performance

PWR Holdings shares financial performance remains strong over the recent years. The group revenue was $51.89m which achieved overall revenue growth of 7.8% compared to the prior corresponding period. PWR Holdings saw strong growth from PWR Europe, with sales rising 27% and Australian sales rising 20% compared to the prior period. PWH also has net cash of A$12.1m and operating cash flow of $16.6 million.

The EBITDA to cash conversion of 101.8% is due to working capital improvements. The flow on effect of the non-cash impact of the loss on sale and write down of assets held for sale at C&R.

| FY16 A$000 | FY17 A$000 | FY18 A$000 | |

| Revenue | 47,348 | 48,117 | 51,889 |

| EBITDA | 16,903 | 14,727 | 16,336 |

| EBITDA Margin | 35.70% | 30.60% | 31.50% |

| NPAT | 8,735 | 9,280 | 11,001 |

| EPS (cents) | 9.31 | 9.28 | 11 |

Strong Growth of the Motorsport Industry

With globalisation, the whole motorsport industry has reached 194 countries and the development of modern technology has increased exposure of this sport across the world.

Social media allows better distribution of content like videos and pictures, while media like the internet and digital channels also lead to more exposure of motorsport.

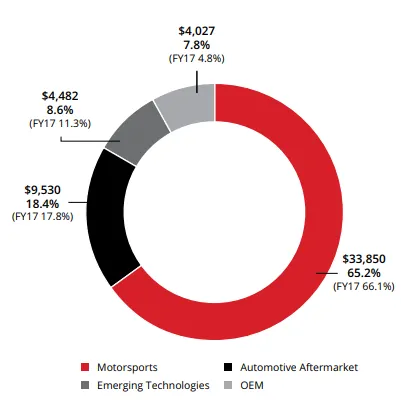

Following this trend, demand PWH’s products also grow with the industry. Motorsport continues to be the major category of PWH’s revenue, accounting for A$33m or two-thirds of their revenue. This is expected to continue until the OEM and emerging technology segments sales increase.

The strong results from PWH were driven mainly by new and existing customers in both Formula One and other motorsports categories as well as increased take-up of complete assemblies instead of core only.

PWH Continues To Research New Technologies

PWH has completed and commissioned the new aluminium heat exchanger core furnace line at C&R Racing in the US, which commenced operation in February 2018. The new throughput capacity of Australia has been doubled due to the new furnace, which provides a solid platform for future growth.

The new furnace provides a number of advantages such as producing cores for the US aftermarket segment, alleviating bottlenecks during peak production periods and providing additional capacity to allow Australia to focus on R&D, design and bespoke production.

In addition, PWH has leased an additional facility at Ormeau adjacent to its existing facilities. The new facility provides an approximately 2,000sqm of additional capacity and can house the specialty product builds and ongoing R&D development.

Capital Investment In Future Capacity

PWH Holdings has invested over $10m in additional capacity for future growth across existing offerings in FY19 and FY20. Additional capital is for new and emerging technology design, development, manufacturing and testing.

Capital investment focused assets increase the capacity of existing plant and equipment to be utilized to supplement both existing products and processes. As PWH mentioned in its 2018 results presentation, emerging technologies long development cycle should start converting into revenue in FY19. In addition, there will be efficiency improvements in operations to ensure sales and opportunity pipeline can be run more efficiently.

PWH Faces Key Skills and IP Risk

PWH may face potential risks from any loss or damage of its key personnel, important facilities and data security, as its operation and profitability rely heavily on these high-tech resources. PWH also implements limited protection over its intellectual properties because it believes it would avoid disclosing the IP to its competitors.

Currency Risk

PWH reports in Australian dollars so the exchange rate has had a lesser impact than previous years, with the pound stronger by 4.7% at 30 June 2018 and the US dollar 4.1% stronger compared to the prior period. However, average rates during the financial year saw US dollar 2.9% weaker but the pound 3.1% stronger.

The net foreign exchange impact had a favourable effect on revenue for the FY18 of $615,395. However, foreign exchange could be a higher risk in the future as global geopolitical insecurity is rising.

Generous Dividend

PWR Holdings shares provide a generous dividend yield for investors. A final dividend of 6.2 cents per share has been declared in its FY18 annual report which is an increase of over 30% on the prior year final dividend of 4.7 cents per share. The full-year dividend for FY18 increased to 7.3 cents per share, up from 5.6 cents per share in the prior year. If PWR Holdings shares continue its strong growth, we can expect dividends grow.

PWR Holdings has gone from strength to strength and continues to grow in a strong industry. With new technology developments, further partnerships with elite racing team in a niche industry with low competition, we expect PWR Holdings shares to have strong upside in the future.