NAB shares (ASX NAB) is one of the four largest banks in Australia in terms of market capitalisation and total assets. As Australia’s largest business bank and fourth largest income tax payer, NAB is also strong in industry financing, banking specialisation and venture capital. This article should help answer if the NAB share price today is worth buying.

Table of Contents

About National Australia Bank (ASX NAB)

National Australia Bank (ASX NAB) offers four segments of banking: Consumer Banking & Wealth, Business & Private Banking, Corporate & Institutional Banking, and New Zealand Banking. It has more than 30,000 people serving 9,000,000 customers at more than 900 locations in Australia, New Zealand and around the world.

NAB Needs Stronger Risk Control

Underlying profit of Business & Private Banking has grown 7% in FY17 as compared to FY16. NAB’s Business & Private Banking covers Government, Education, Community & Franchising, agriculture, health, CRE and SME. Among them, Government, Education, Community & Franchising business lending has grown the most, at 12.5% on a YOY basis. This echoes with NAB’s outlook that “an upswing in business investment and government infrastructure spending are forecast to support economic growth”. NAB has launched chatbot, a 24/7 “digital virtual banker” designed to help its SME customers and improve efficiency. It is a virtual assistant who can answer more than 13,000 variations on more than 200 questions relating to business accounts.

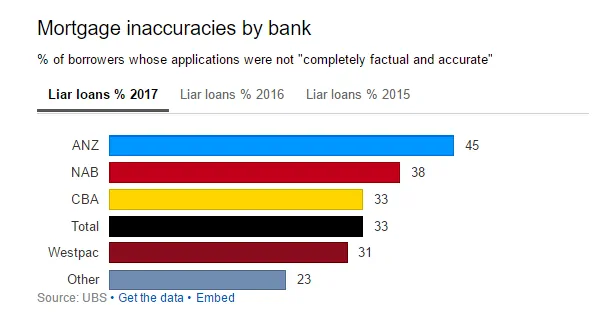

However, NAB shares have been battling risk management headwinds. In Nov 2017, NAB sacked 20 bankers and further disciplined 32 after the bank found they had been granting home loans, or ‘liar loans’ based on incorrect information. The problem was partly due to third-party housing brokers, who failed to carry out due diligence. Astonishingly, according to UBS’s survey of mortgage borrowers, 25 percent of people admitted the information they gave was “mostly factual and accurate”.

Banks Build On AI and Blockchain

NAB is well aware of the current market well-defined by automation and digitisation. It has been partnering with realestate.com.au to offer simplified and instant mortgage solutions to loan borrowers. The bank makes the first initiative industry-wide to offer voice-activated experience via Google Home and Google Assistant. In New Zealand, digital wallet kickstarts the retail banking digitisation. All of these are supported by NAB’s global venture capital investment and constant efforts to builder a wider ecosystem.

But that may not be enough. Numerous global case studies suggest that global tech giants such as Amazon will pose a true threat to banks. Launched 6 years ago, Amazon Lending has the unique advantage of using their sales data on the platform to measure risk. Globally, platforms like Alibaba and Amazon are taking over banks as traditional borrowers. Couple with that, banks need support from companies like Amazon to back up AI innovation. World Economic Forum pointed out that financial institutions are dependent on large tech firms to acquire critical infrastructure or they will risk falling behind. Ultimately, power will transfer to the owner of the customer experience.

Following the massive layoff, banks are catching up with streamlining and cost reduction. NAB stock joined IBM’s blockchain-powered Pacific payment network last year, with the aim of reducing cross-border settlement time and cost. New financial services infrastructure built on distributed ledger technology will redraw transaction processes, such as syndicated loans, trade finance, compliance and investor voting.

Flat Financial Performance, More To Expect

At the time of writing and at the current NAB share price today, NAB shares current PE ratio stands at 15.45, a little higher than Commonwealth Bank’s (ASX CBA) 13.18 and Westpac’s (ASX WBC) 12.9. With the industry PE ratio at 12.3, the NAB share price today is trading a bit more expensive and it is not strongly supported by the underlying financials.

ASX NAB shares profit margin is currently the lowest among the big four banks. With the profit margin of CBA at 38.75%, WBC at 38.14%, Australia & New Zealand Banking Corporation (ASX ANZ) at 33.58%, NAB shares has a profit margin of 30.74%. From the below-listed cost to income ratio of four sectors, we see a growing cost to income ratio in wealth management. Cost of consumer banking, business and private banking, corporate and institutional banking have declined.

CBA still leads the ROE ratio. CBA has the highest ratio of 15.66%, followed by WBC 13.38%, NAB stock at 12.04%, and ANZ 10.98%. In terms of cash ROE, NAB stock is catching up with its peers as is shown below.

NPS or net promoter score of branch interaction has grown strong from Sep 16 to Sep 17 by 51. However, from Jul 13 to Sep 17, NPS of small business has declined by 16, homeowners by 23, and investors by 16. Only medium business witnessed a growth of 3.

2018 has seen a more volatile global market with a drastic downturn in US equities and bonds, coupled with Trump’s tariff initiatives. Politically, Asia and Eurozone are faced with uncertainties. Although Australian economy has been stable for the past 26 years, a sluggish housing market casts doubt on stronger GDP growth. However, we don’t see a real estate market crash coming any time soon.

Provided the real estate market doesn’t crash and NAB continues to innovate, even against the backdrop of the Royal Commission, the NAB share price today is still worth buying as profits remain strong.