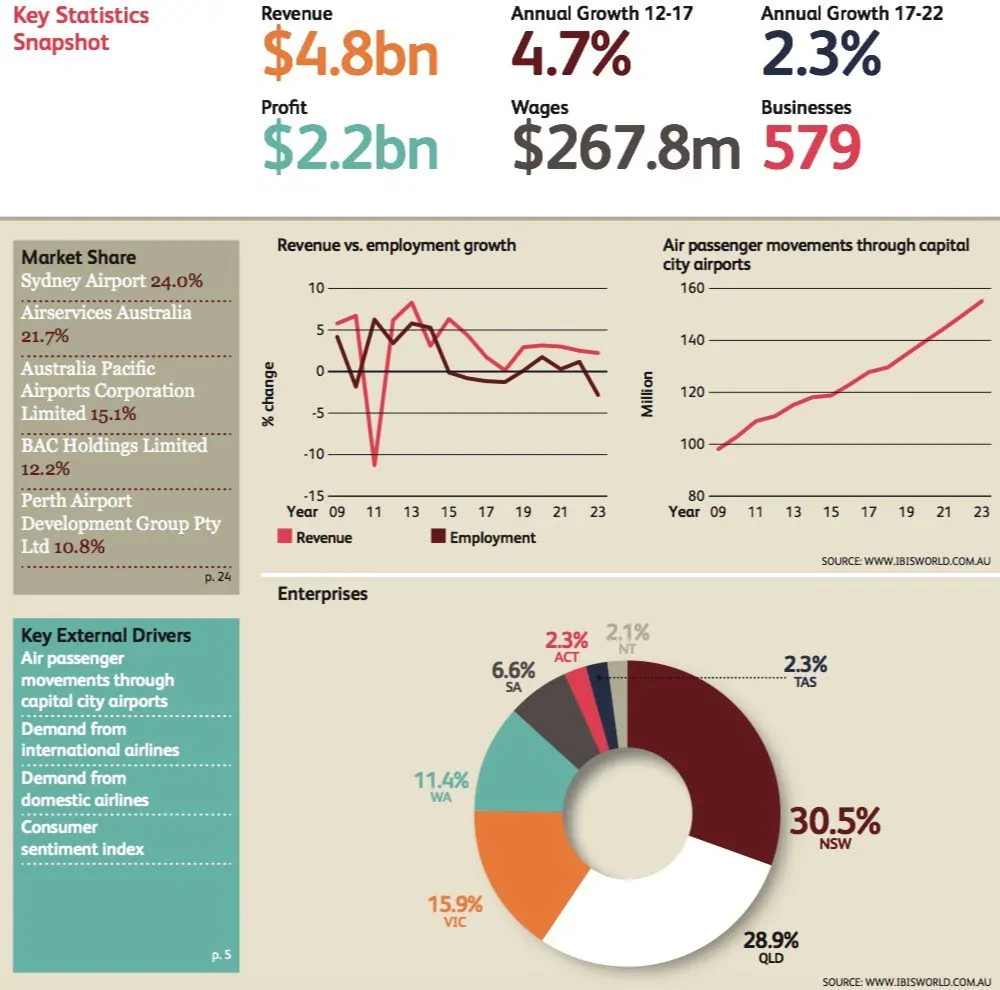

Sydney Airport Shares (ASX SYD) grew at an annualised 4.2% ($1.1 billion) from 2012 to 2017, which underperformed the overall industry (4.7%, $4.8 billion). Although SYD shares has lower annualised revenue growth compared to industry peers, SYD stock has the largest market share at 24%, thus it is reasonable for the market leader to have relatively stable growth.

Other major industry players like APAC was estimated to grow at 9.0% annually ($724.6 million), Brisbane Airport (6.5%, $583.5million) and Perth Airport (9.8%, $516.6 million).

Sydney Airport Holdings (ASX SYD) has traditionally been the transportation hub of Australia, with the largest share of passenger movements over the past five years. The Australian airport operation industry has been relatively volatile over the past decade and experiencing slow growth in 2017.

Customer demand, policy tightening, increasing costs and capacity issues are widely known elements which impact companies such as Sydney Airport. Even though there are challenges, Sydney Airport shares, with the largest market cap of more than $15 billion within the Australian industry, outperforms its peers in general.

Table of Contents

Slow But Strong Growth In Sales Revenue

Sales revenue forecast for 2017-2019

| A$(m) | 2017E | 2018E | 2019E |

| Revenue | $1,464.00 | $1,557.00 | $1,660.00 |

| Growth | 7.33% | 6.35% | 6.62% |

The revenue growth is driven by 4 key inputs, passenger growth, capital investment, management initiatives and inflation/fixed escalations.

The international passenger growth especially Chinese passenger is expected to grow significantly due to the China-Australia air services agreement. Further demand from the Middle East, Indian, New Zealand and other Asian markets is also expected to provide more opportunities to extend new routes and additional seat capacity.

Furthermore, due to the new duty-free shops launched in 2016, it is forecasted that the rental return for retail business maintains consistent growth in 2017.

Promising Earnings Growth At A Slow Pace

Earning growth (EBITDA excluding one-offs) of SYD shares in 2016 was 10.3%, a leap compared with 5.7% in 2015. The pace is expected to slow in a 5-year term. The increasing passenger and aircraft numbers benefit companies in the whole industry, offering growth opportunities.

While the capacity issue may impose restrictions on the growth, many airports would operate close to capacity including SYD stock. Thus the growth rate of Sydney Airport will be at a slower pace from a fast pace last year.

2015-2020 SYD airport earning growth

| A$(m) | 2015 | 2016 | 2017E | 2018E | 2019E | 2020E |

| EBITDA

(Excluding one-offs) |

1004 |

1107 |

1178 |

1250 |

1318 |

1382 |

| Growth | 5.7% | 10.3% | 6.7% | 5.9% | 5.5% | 4.8% |

Source: Morgan in alliance with CIMB

Earning growth and robust cash flow support solid investor return

The total shareholders return grew steadily—24.2% five-year CAGR from 2011 to 2016. SYD shares have performed well in the past few years and have contributed to earnings growth and robust operating cash flow growth.

Table2: P/E ratio peers comparison

| Current PE | PE 2018E | |

| Sydney Airport Holdings | 48.51 | 38.90 |

| Aeroports de Paris SA | 33.73 | 28.89 |

| Shanghai International Airport Co Ltd | 30.27 | 21.05 |

| Auckland International Airport Ltd | 23.79 | 30.09 |

Compared with peer companies with similar market capital, Sydney Airport shares current P/E of 48.5 is higher than some major industry players in New Zealand, China and France. Hence in comparison to industry, Sydney Airport is overpriced.

Whereas according to Goldman Sachs, Sydney Airport shares expected P/E ratio in 2018 to be 38.9x. The fall in PE indicates that Sydney Airport stock will be cheaper in FY2018.

Growth Potential With Second Airport

Western Sydney Airport, as the second airport in Sydney, is expected to be completed in 2026. SYD Stock has growth potential with the sole Right Of First Refusal (ROFR) to build and operate the second Sydney Airport.

As the number of passengers flying into Sydney continues to grow, by seizing this opportunity to build a new airport, Sydney Airport will be able to keep up with demand.

Western Sydney Airport Won’t Hurt SYD Stock Revenue

If Sydney Airport does not choose to operate Western Sydney Airport, it may lose market share but effects may be limited.

Western Sydney Airport is 61kms away from the CBD, while the current one is only 8kms with slightly more expensive flights. From consumers’ perspective, customers are likely to choose the more time efficient airport of which the additional cost is not significant.

Taking a similar situation such as the second airport in Melbourne (Avalon), an additional airport did not impact strongly on the main Tullamarine Airport revenue and this may be the case for Sydney Airport. Therefore, the demand for flying in and out of Sydney Airport will be maintained, while Western Sydney Airport might merely run a certain amount of domestic flights.

Despite the slow growth of the Australian airport industry, Sydney Airport Holdings still has the prospective earnings growth and unique geographical advantage. Morningstar continues to view Sydney Airport shares favourably whilst Goldman Sachs maintains a target price of $8.12.